Hsmb Advisory Llc Things To Know Before You Get This

Hsmb Advisory Llc Things To Know Before You Get This

Blog Article

Hsmb Advisory Llc for Dummies

Table of ContentsFascination About Hsmb Advisory Llc9 Simple Techniques For Hsmb Advisory LlcSee This Report about Hsmb Advisory LlcThe smart Trick of Hsmb Advisory Llc That Nobody is DiscussingExcitement About Hsmb Advisory LlcHsmb Advisory Llc for Beginners

Ford states to avoid "cash money worth or long-term" life insurance policy, which is even more of an investment than an insurance policy. "Those are extremely made complex, included high commissions, and 9 out of 10 individuals don't require them. They're oversold since insurance representatives make the biggest commissions on these," he claims.

Disability insurance coverage can be expensive. And for those that decide for long-lasting treatment insurance coverage, this plan may make disability insurance unneeded.

Some Known Details About Hsmb Advisory Llc

If you have a persistent wellness worry, this kind of insurance policy might end up being crucial (Health Insurance). Nonetheless, do not let it emphasize you or your bank account early in lifeit's normally best to secure a plan in your 50s or 60s with the expectancy that you will not be using it up until your 70s or later on.

If you're a small-business proprietor, consider safeguarding your source of income by acquiring organization insurance policy. In case of a disaster-related closure or period of rebuilding, company insurance coverage can cover your revenue loss. Think about if a substantial climate occasion impacted your shop or manufacturing facilityhow would certainly that impact your income? And for for how long? According to a report by FEMA, between 4060% of small companies never ever reopen their doors complying with a disaster.

And also, making use of insurance might sometimes cost more than it conserves in the future. For instance, if you obtain a chip in your windscreen, you might consider covering the repair work cost with your emergency situation cost savings instead of your auto insurance policy. Why? Because using your car insurance policy can cause your month-to-month premium to rise.

The Only Guide for Hsmb Advisory Llc

Share these suggestions to shield enjoyed ones from being both underinsured and overinsuredand talk to a trusted professional when needed. (http://tupalo.com/en/users/6280892)

Insurance policy that is bought by a web link specific for single-person coverage or coverage of a family members. The private pays the costs, in contrast to employer-based health and wellness insurance where the company frequently pays a share of the premium. Individuals might buy and purchase insurance coverage from any type of plans readily available in the individual's geographical region.

Individuals and family members might get economic assistance to lower the expense of insurance premiums and out-of-pocket costs, but just when enlisting through Link for Health Colorado. If you experience specific changes in your life,, you are qualified for a 60-day period of time where you can enlist in a specific strategy, also if it is outside of the annual open registration period of Nov.

10 Simple Techniques For Hsmb Advisory Llc

- Link for Health Colorado has a full listing of these Qualifying Life Events. Reliant youngsters that are under age 26 are eligible to be included as relative under a parent's protection.

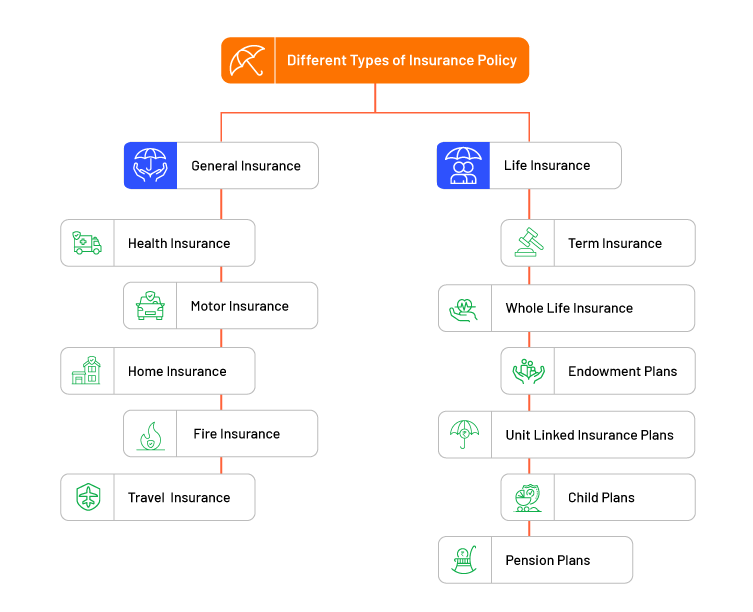

It might seem basic yet understanding insurance coverage types can likewise be confusing. Much of this complication originates from the insurance policy industry's recurring objective to design individualized insurance coverage for insurance policy holders. In designing flexible plans, there are a range to pick fromand every one of those insurance types can make it hard to comprehend what a particular policy is and does.Some Ideas on Hsmb Advisory Llc You Need To Know

If you pass away during this period, the individual or people you've named as beneficiaries may get the cash payout of the plan.

Nevertheless, lots of term life insurance coverage policies allow you convert them to a whole life insurance policy policy, so you do not shed protection. Typically, term life insurance policy policy premium payments (what you pay each month or year right into your plan) are not locked in at the time of acquisition, so every five or ten years you have the policy, your costs could rise.

They also tend to be more affordable overall than whole life, unless you buy a whole life insurance policy policy when you're young. There are likewise a few variants on term life insurance. One, called team term life insurance policy, is usual amongst insurance coverage alternatives you may have accessibility to through your company.Unknown Facts About Hsmb Advisory Llc

This is commonly done at no expense to the employee, with the capability to purchase added insurance coverage that's secured of the employee's income. An additional variation that you may have access to through your employer is supplementary life insurance policy (Life Insurance). Supplemental life insurance coverage can consist of unexpected death and dismemberment (AD&D) insurance coverage, or funeral insuranceadditional insurance coverage that might assist your family members in case something unforeseen occurs to you.

Irreversible life insurance just describes any life insurance coverage policy that doesn't expire. There are a number of kinds of irreversible life insurancethe most typical types being entire life insurance policy and global life insurance policy. Whole life insurance policy is specifically what it seems like: life insurance policy for your entire life that pays out to your recipients when you pass away.

Report this page